Canada Housing Benefit

The one-time top-up to the Canada Housing Benefit aims to help low-income renters with the cost of renting. Who can apply for the one-time 500 payment.

Canada Government Introduces Canada Housing Benefit In 10 Year National Housing Strategy Indiablooms First Portal On Digital News Management

The Canada Housing Benefit is designed to help low-income renters with their housing payments.

. You should receive the Canada Housing Benefit top-up if. Impacts on provincial or territorial benefits will be determined at the discretion of each province or territory. 17 hours agoLower-income renters in Canada can now apply for the 500 one-time top-up to the Canada Housing Benefit through their Canada Revenue Agency CRA My AccountTo qualify for the benefit tax-paying Canadians must be at least 15 years of age with an adjusted family net income of 20000 or less for individuals or 35000 or less for families.

21 hours agoHeres what we know about the top-up to the Canada Housing Benefit. Proposed new benefit for renters. The payment would be launched by the end of the.

The government is proposing a new one-time top-up to the Canada Housing Benefit to help low-income renters with their housing costs. This one-time top-up will provide a tax-free payment of 500 to those who qualify and the money will go towards rent relief. The proposed one-time top-up to the Canada Housing Benefit program would consist of a tax-free payment of 500 to provide direct support to low-income rentersthose most exposed to inflationwho are experiencing housing affordability challenges.

Benefits and programs including eligibility. You may be eligible to apply if your income and the amount that you pay on rent qualify. The Canada Revenue Agency CRA administers this one-time payment.

Affordability support for low-income renters. You are a. You were renting a principal residence in Canada on December 1 2022.

Applications may be available in December 2022. Housing rebate financial assistance for home repairs improve accessibility for disabled occupants increase energy-efficiency. 21 hours agoThe Liberals announced the one-time 500 federal boost to the existing Canada Housing Benefit program in the fall pledging to help those eligible cover the cost of rent as it continues to rise.

You may be eligible for a tax-free one-time payment of 500 if your income and the amount that you pay on rent qualify. Disability pensions and childrens benefits education funding savings plans gasoline tax refund program. The one-time top-up to the Canada Housing Benefit does not reduce other federal income-tested benefits such as the Canada Workers Benefit Canada Child Benefit Goods and Services Tax Credit and Guaranteed Income Supplement.

The federal government estimates that 18 million Canadians are eligible for the. You were at least 15 years old on December 1 2022.

Should You Apply For The 2022 Canada Ontario Housing Benefit Kingsville Times

Drew Dilkens On Twitter Two New Housing Benefits Are Now Available To Help Low Income Residents Afford Rent The Windsor Essex Housing Benefit Wehb And Canada Ontario Housing Benefit Cohb Are Paid Monthly

Arklkyosympb6m

Here S How You Can Get An Extra 500 From The Canada Housing Benefit Urbanized

New One Time Top Up To The Canada Housing Benefit Sinneave Family Foundation

How To Apply For The Canada Housing Benefit Top Up Ctv News

Cra Who Can Apply For The Canada Housing Benefit Squamish Chief

35yptbngo6hznm

Strings Attached The National Housing Strategy Won T Help People Struggling With Homelessness Now Pivot Legal Society

Cra Who Can Apply For The Canada Housing Benefit Powell River Peak

Liberals Detail 40b For 10 Year National Housing Strategy Introduce Canada Housing Benefit Cbc News

R0cvzljoqb2jwm

Cost Estimate Of The One Time Top Up To The Canada Housing Benefit Program

Qt1l5wcoo2 8fm

Canada Nova Scotia Targeted Housing Benefit Town News

N B Latest Province To Commit To Housing Benefit 91 9 The Bend

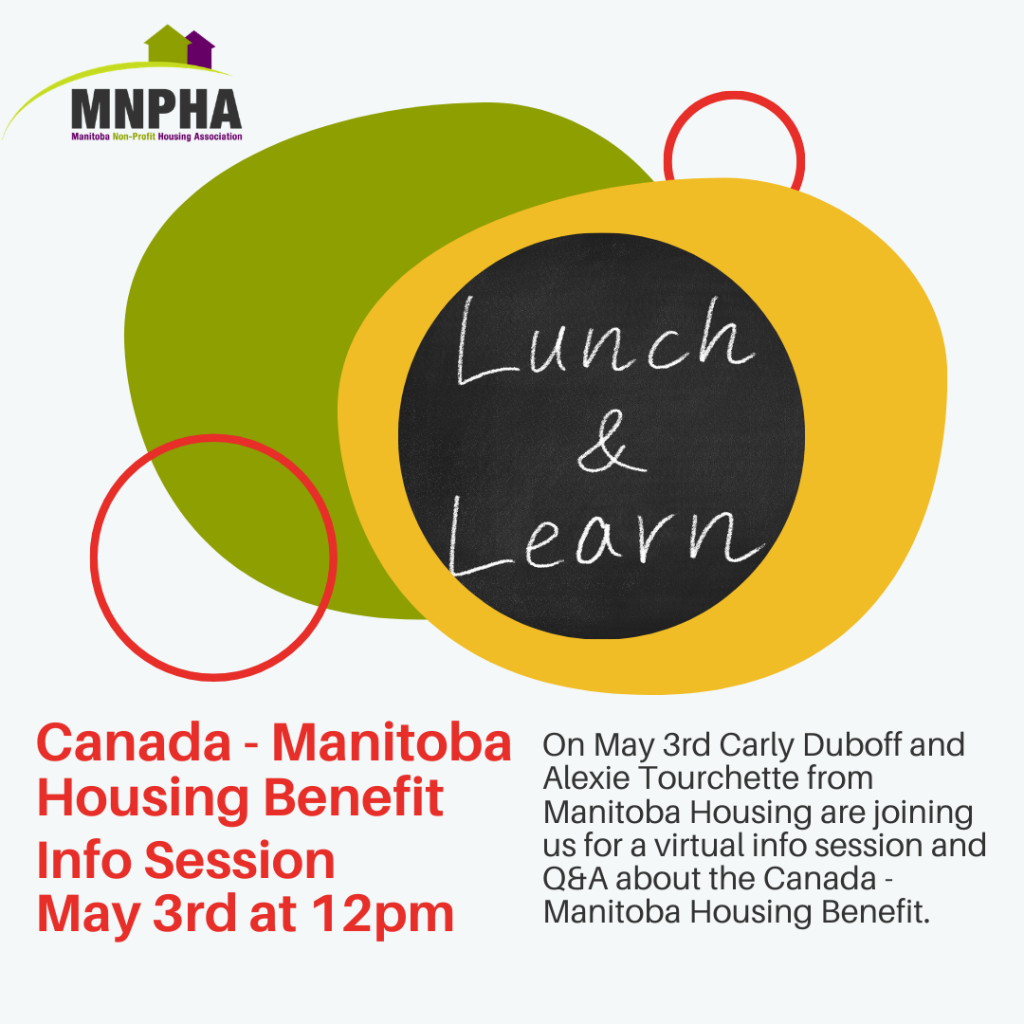

Past Events Mnpha Manitoba Non Profit Housing Association